Same rules apply to any lease on an electric vehicle as well. That means any used EVs you already have or are going to purchase are already disqualified.

This credit applies to the original registered owner only. If that is the case, credits for Toyota EVs (PHEVs rather) will be phased out gradually into 2023, so you may still qualify for a credit, but it will be dwindling on borrowed time.Īnother important rule to keep in mind is that the federal tax credit cannot be passed on. Most recently, Toyota announced its on the verge of passing 200,000 EVs sold therefore losing eligibility for federal tax credits.Īt this rate, the Japanese automaker expects to hit 200k in late June of 2022. Other automakers like General Motors have also reached that threshold and could benefit from revised legislation to reinstate the credit. Fear not, Tesla owners, there are still ways to save money on your EV purchase! See the “tax incentives for Tesla buyers” section below. This includes US automakers like Tesla, who topped over 200,000 qualified plug-in electrics sold a few years ago, and as a result no longer qualifies for any federal tax credit. As the demand for electric vehicles increases, sales push certain manufacturers over the predetermined threshold of qualified sales… at least for now. This is the US government, after all.įirst, understand that these federal tax credits will not last forever, and they may have already expired for your vehicle. Hopefully you better understand how the government determines its tax credits for individuals based on your federal income tax and vehicle, but it’s important to stay aware of additional fine print. Other federal tax credit rules to note as an electric vehicle owner It’s important to note that any unused portion of the $7,500 is not available as a refund, nor as a credit for next year’s taxes.

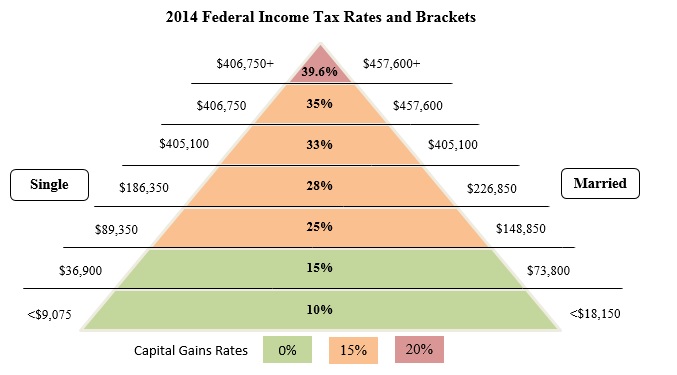

Irs.gov tax table for 2016 full#

If you owed $10,000 in federal income tax, then you would qualify for the full $7,500 credit. At first glance, this credit may sound like a simple flat rate, but that is unfortunately not the case.įor example, if you owned a Nissan LEAF and owed say, $3,500 in income tax this year, then that is the federal tax credit you would receive. How much is the federal tax credit?įirst and foremost, it’s important to understand three little words the government slips in front of the $7,500 credit – “may” and “up to.” As in, you may qualify for up to $7,500 in federal tax credit for your electric vehicle. In reality, the amount you qualify for is based on both your income tax as well as the size of the electric battery in the vehicle you own. With that said, you cannot simply go out and buy an electric vehicle and expect Uncle Sam to cut $7,500 off your taxes in April. The idea in theory is quite simple - “All electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to $7,500,” according to the US Department of Energy. How does a federal tax credit work for my EV?

0 kommentar(er)

0 kommentar(er)